Modernising deposit return systems could bring the United States’ recycling up to speed with other programmes around the world.

This article by Samantha Millette and Clarissa Morawski was originally published in Resource Recycling Magazine.

The United States is grappling with a growing recycling crisis. Despite decades of environmental campaigns and investments in recycling infrastructure, recycling rates have stagnated, with many states seeing declines. According to Ball Packaging’s latest 50 States of Recycling report, only 32% of the material value in the packaging waste stream is being captured for recycling, leading to an estimated $6.5 billion worth of valuable materials lost to landfills annually.

Beverage containers (aluminium cans, plastic bottles and glass) are some of the most recyclable materials, yet millions still go to waste each year. In fact, between 2015 and 2024, an estimated 1.5 trillion beverage containers were wasted in the U.S., including 785 billion PET bottles, 553 billion metal cans and 220 billion glass bottles, according to Reloop’s What We Waste Dashboard. Americans wasted an average of 504 beverage containers per person in 2024 alone, including 60 glass bottles, 181 metal cans and 263 PET bottles. If current collection for recycling rates remain unchanged, an additional 878.6 billion beverage containers are expected to be wasted between 2025 and 2029.

Deposit return systems, known as “bottle bills” in the U.S., offer a proven solution. Operating in 57 jurisdictions worldwide, including 10 U.S. states, these programmes incentivise recycling by attaching refundable deposits to beverage containers, encouraging consumers to return them to designated collection points. In the last four years alone, 11 countries and territories have introduced a deposit system including two Australian states, Austria, Slovakia, Latvia, Malta, Romania, and the Republic of Ireland.

If a national best-in-class DRS were introduced today in the U.S., an estimated 447 billion units of beverage containers could be captured instead of lost. This includes 206.4 billion PET bottles, 172.8 billion metal cans and 68.5 billion glass bottles. Recycling these 447 billion containers could generate nearly 30.7 million tonnes of material for reuse, valued at approximately $5.5 billion USD at 2024 prices, while avoiding over 31 million tonnes of carbon emissions — equivalent to not burning 17.4 million tons of coal or saving 3.5 billion gallons of gasoline.

In 2023, 9 of the 10 states with the highest recycling rates had bottle bill programmes, the Ball report found. On average, states with DRS recycle 27% more packaging (excluding fibre and flexible plastics) through closed-loop end markets compared to non-DRS states (34% versus 7%). For PET bottles specifically, states with bottle bills recycle over 3.5 times more on a per-capita basis than those without. Although these 10 states represent just 27% of the U.S. population, they account for 47% of all packaging (excluding FFP) recycled and 51% of all beverage containers recycled nationwide.

Despite these successes, there remains significant untapped potential. Expanding and modernising existing bottle bill programmes, as well as introducing new ones in states without them, could dramatically boost recycling rates, reduce waste and recover billions of dollars in valuable materials currently lost to disposal. Additionally, these programmes could provide brand owners with an increased supply of recycled feedstock, helping them meet both voluntary and legislated recycled content targets.

Unlocking Untapped Potential in U.S. Bottle Bill Programmes

While states with DRS consistently outperform their non-DRS counterparts, many U.S. bottle bill programmes are outdated and underperform compared to international leaders.

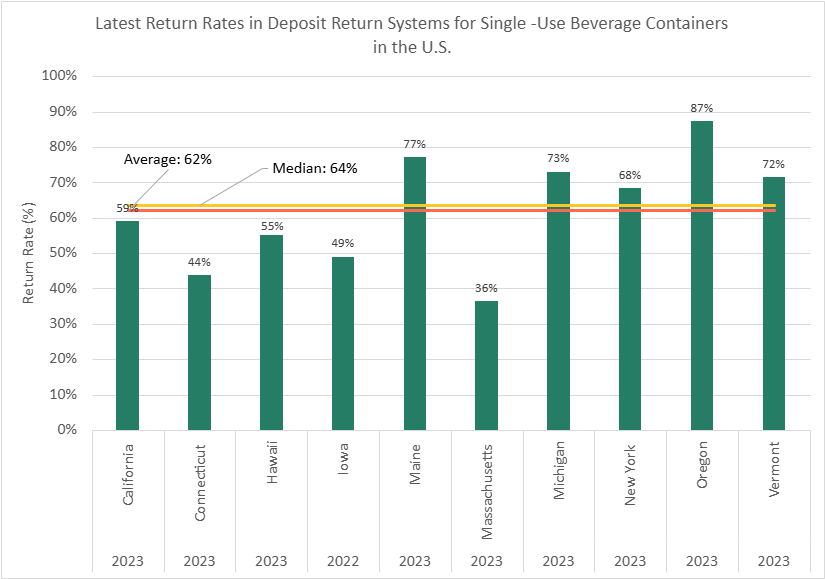

Reloop’s Global Deposit Book 2024, released in December, revealed that the average return rate for single-use beverage containers in U.S. DRS programs was just 62% in 2023, much lower than the European average of 87% and the Canadian average of 76%.

Figure 1. Latest return rates in deposit return systems for single-use beverage containers in the U.S. (excludes material collected from kerbside recycling programmes or MRFs).

Why do U.S. programmes lag behind, and what can be done?

Reloop’s analysis of over 50 deposit return systems worldwide highlights three critical factors that significantly impact return rates:

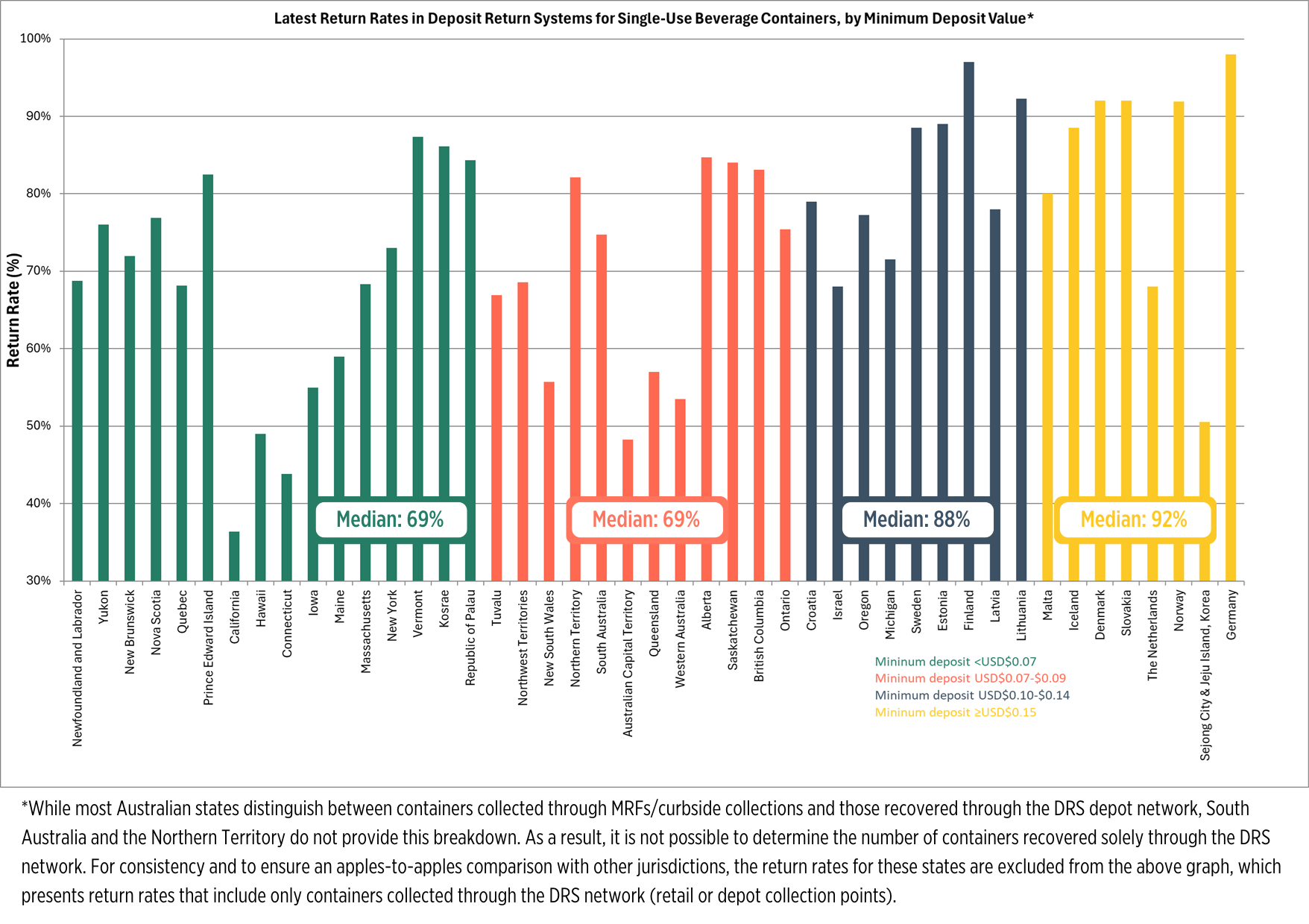

Deposit values: Higher deposit values are strongly correlated with higher return rates. Reloop’s data shows that jurisdictions with minimum deposits below USD$0.10 achieve a median return rate of 69%, while those with deposits of at least USD$0.15 reach a median return rate of 92%.

Figure 2. Latest return rates in deposit return systems for single-use beverage containers, by minimum deposit value in dollars (excludes material collected from kerbside recycling programmes or MRFs).

In 2023, Michigan and Oregon were the only two states with a $0.10 minimum deposit, and they achieved two of the top three return rates among U.S. bottle bill programmes. However, $0.10 is much lower than deposits in most leading international DRS programmes, such as Germany (USD$0.26), Norway (USD$0.18-$0.26), Finland (USD$0.10-$0.41) and Denmark (USD$0.14-$0.42), where return rates exceed 90%.

Many U.S. bottle bill programmes have also failed to adjust deposit amounts for inflation, eroding their value over time. This reduces the incentive for consumers to participate and contributes to return fatigue, where the effort of returning containers outweighs the perceived reward. Oregon’s experience demonstrates the impact of increasing deposit values: when the state doubled its deposit from USD$0.05 to $0.10 in 2017, the redemption rate climbed 22% within three years.

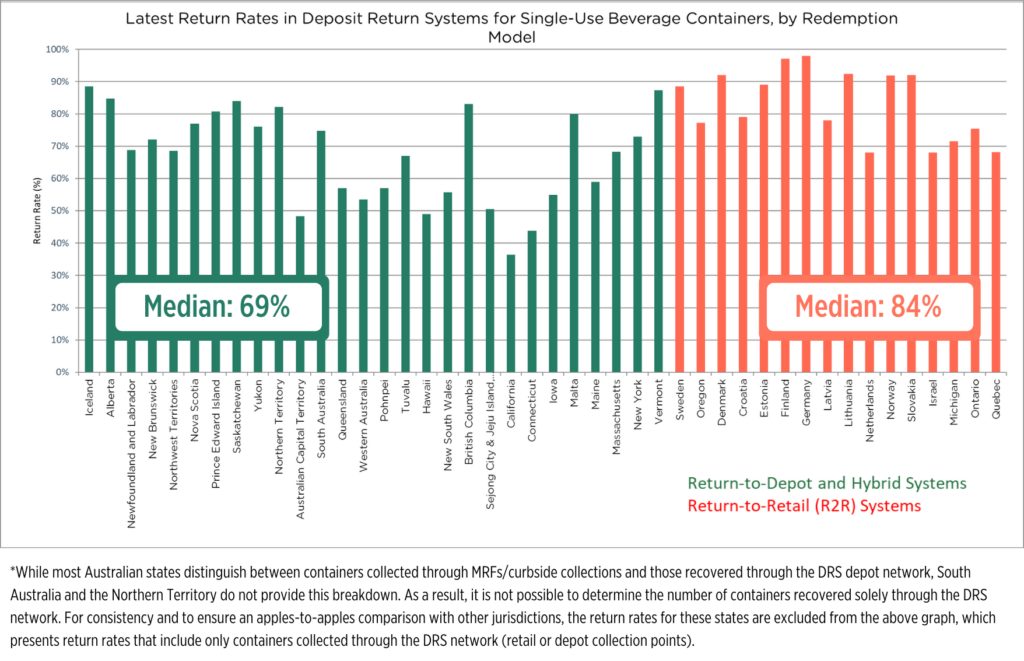

Convenient return processes: Accessibility of return options plays a major role in DRS performance. Jurisdictions with a return-to-retail (R2R) model — where retailers are legally required to accept container returns and pay out refunds — achieve a median return rate of 84%. This is significantly higher than the 69% median return rate in jurisdictions relying on redemption centres or a hybrid model, where redemption centres operate alongside retail stores.

Among U.S. states with bottle bills, only Michigan operates a pure R2R model. Michigan law mandates that retailers accept containers of the same kinds, sizes and brands they sell, with no opt-out provisions. In contrast, other states operate hybrid redemption models that often allow retailers to opt-out if they meet certain criteria, such as proximity to a redemption centre. These systems are less convenient than R2R models, which allow consumers to return containers where they shop.

Figure 3 Latest return rates in deposit return systems for single-use beverage containers, by redemption model (excludes material collected from kerbside recycling programmes or material recovery facilities [MRFs])

Comprehensive scope: Programmes with broad scopes that include a wide range of beverages and container types consistently achieve higher return rates. New York’s experience highlights this: When water bottles were added to its system in 2009, the number of PET plastic containers returned for recycling doubled, according to a 2021 report. Similarly, Denmark provides a compelling example. Despite already achieving a world-leading beverage packaging recycling rate of 90% in 2018, the Danish government expanded its DRS in 2020 to include single-use juice and concentrate bottles, which it projected would result in an additional 52 million bottles being recycled annually, increasing the volume of recyclable packaging in the system by 4-5%.

In the U.S., some states exclude significant beverage categories from their bottle bill programmes, such as non-carbonated beverages (e.g., bottled water, juice, milk), wine and spirits, and sports drinks. These exclusions limit the volume of materials captured and the programme’s overall effectiveness.

| Jurisdiction | Redemption Model | Population per Redemption Point | Programme Scope | Deposit Value | Overall Return Rate (%) |

|---|---|---|---|---|---|

| Alberta | Return-to-redemption center (depot) | 21,945 | All | Variable rate: CAD$0.10-$0.25 (USD$0.07-0.17) | 85% (2023) |

| British Columbia | Hybrid | 2,204 | All | Fixed rate: CAD$0.10 (USD$0.07X) | 83% (2023) |

| Finland | Return-to-retail | 1,401 | All (except milk) | Variable-rate: €0.10-0.40 (USD$0.10-0.41) | 97% (2023) |

| Lithuania | Return-to-retail | 1,110 | All | €0.10 (USD$0.10) | 92% (2023) |

Table 1. Key design elements of selected leading international deposit return systems.

Progress and Challenges

Several states are making strides toward modernising their bottle bill programmes, even as challenges remain.

In Connecticut, the DRS was expanded to cover additional beverages (non-carbonated beverages, hard cider, and malt-based seltzer) in January 2023, and the deposit amount doubled from USD $0.05 to $0.10 on January 1, 2024. Early results are promising: By Q3 2024, Connecticut reported a return rate of 74.2%, a nearly 24-point jump from the end of 2023 and a 29-point increase compared to Q3 2023. This marks the state’s highest quarterly return rate since December 2013 (76.1%), according to state data.

California has also taken major steps forward. Effective January 1, 2024, its bottle bill now includes wine and distilled spirits, as well as 100% fruit and vegetable juices. According to the Container Recycling Institute, these changes have resulted in the recycling of over half a billion additional bottles and cans annually.

Other states, including Massachusetts and New York, have encountered obstacles in their modernisation efforts. In Massachusetts, a proposal to increase deposit values, handling fees and beverage coverage as part of a broader climate bill failed to pass before the legislative session ended. Similarly, New York’s proposed 2024 updates, which aimed to raise deposit values and expand programme scope, didn’t advance. Despite these setbacks, the ongoing discussions signal growing interest in improving DRS programmes nationwide.

What’s Driving Global Momentum for DRS?

Beyond the U.S., the adoption of deposit systems is rapidly accelerating, as an increasing number of governments recognise their effectiveness in boosting recycling rates and tackling the global challenges of plastic pollution and climate change.

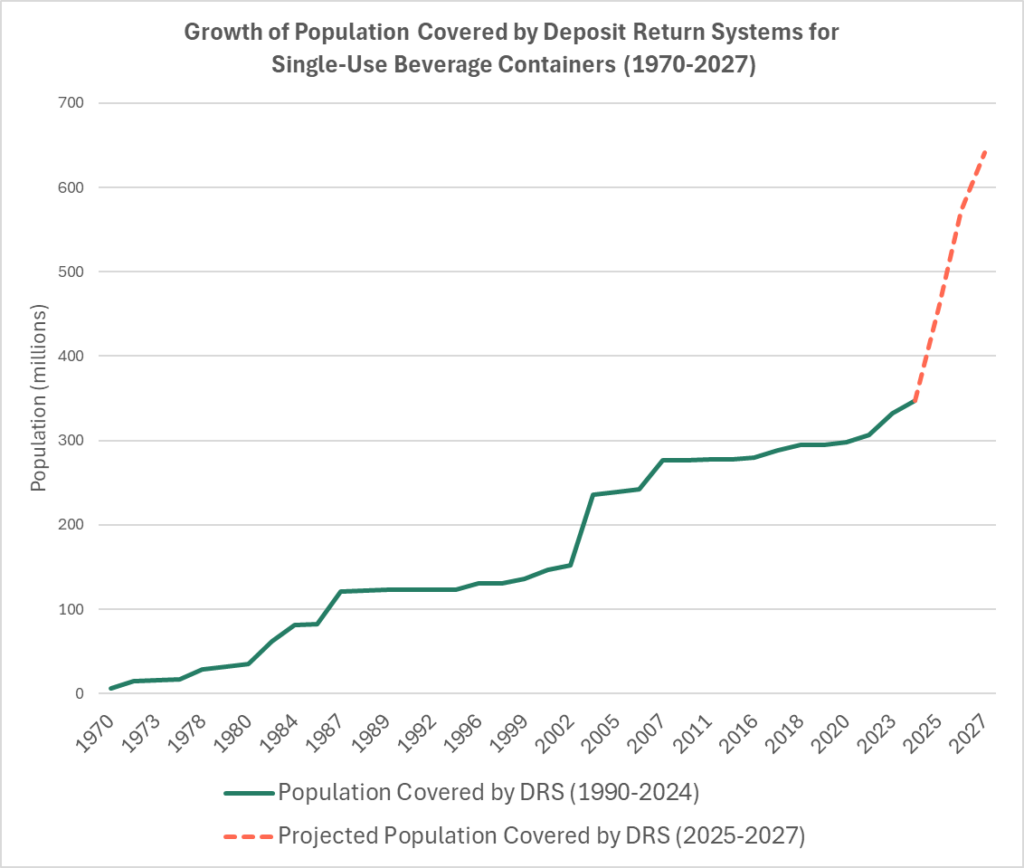

Reloop’s Global Deposit Book 2024 reveals that as of January, nearly 357 million people live in jurisdictions with DRS for single-use beverage containers. With the expected implementation of already-announced legislation, this figure is expected to grow to approximately 641 million people across 70 jurisdictions by the end of 2027. Among the countries and regions set to launch new DRS programmes in the coming years are Poland (October 2025), Türkiye (2025), the Australian state of Tasmania (2025), the Czech Republic (2026), Singapore (2026), Portugal (2026) and the four nations of the U.K. (2027). Spain is also expected to introduce a DRS by the end of 2026. A recent government report from Madrid confirmed that Spain fell short of its 2023 target to separately collect 70% of plastic bottles, triggering a legal requirement to implement a DRS within two years.

Figure 4. Growth of population covered by deposit return systems for single-use beverage containers (1970-2024 actual; 2025-2027 projected).

This global surge in DRS adoption is fueled by several key factors:

Proven effectiveness: DRS consistently outperforms other collection systems, achieving recovery rates of 90% or higher for beverage containers. Glass Packaging Institute data shows that glass bottle recycling rates are 63% in DRS states compared to just 24% in non-DRS states. Similar differences can be seen for aluminium cans: The 10 states with DRS boast an average aluminium can recycling rate of 68% compared to an average of 22% in non-DRS states. A 2024 Massachusetts Institute of Technology study concluded that implementing a nationwide DRS in the U.S. could significantly increase the U.S. recycling rate for PET bottles, from 29% (2022) to 82%.

Legislated recycling targets: The European Union’s new Packaging and Packaging Waste Regulation, adopted in 2024, mandates a 90% separate collection for recycling rate for plastic bottles and cans by 2029. To meet this target, member states must implement a DRS unless they achieve an 80% collection rate by 2026. Although member states can avoid DRS if they reach the 80% target, it will be nearly impossible for many of them, with current collection rates below 60% (e.g., Spain, France, and Italy), to do so without a DRS in place.

Strong public support: Multiple recent polls highlight this widespread approval for such systems. A 2022 nationwide survey of U.S. voters from the Aluminum Association found that 81% were in favour of DRS programmes, with strong support across all political and demographic groups. A 2024 poll of Massachusetts residents showed that 87% were in support of having a bottle bill programme and that 82% were in favour of expanding it to cover additional beverages. Respondents cited municipal and taxpayer savings, reduced greenhouse gas emissions and improved recycling outcomes as key benefits.

Increasing industry support: Major industry groups, including the Can Manufacturers Institute and Aluminum Association, have endorsed DRS as essential for securing clean materials to meet sustainability goals. In its latest aluminium beverage can recycling rate targets progress report, the Aluminum Association and CMI identify the implementation of well-designed deposit systems at both the state and federal levels as a key strategy for making progress toward achieving its aluminium can recycling targets. According to the CMI, a national DRS could deliver a 48-percentage point increase in the U.S. aluminium beverage can recycling rate (50 billion more aluminium beverage cans would be recycled).

Recycled content mandates: Legislation requiring recycled content in packaging has increased demand for high-quality recyclables. DRS programmes are uniquely positioned to supply clean, uncontaminated materials, ensuring manufacturers meet these requirements efficiently. The 2024 MIT study found that the supply needs of packaging producers could be met through a nationwide DRS with a $0.10 deposit at a net cost of about $0.01 per bottle produced when demand is strong.

Conclusion: A Clear Path Forward

The U.S. recycling system is at a crossroads. Stagnating recycling rates and the loss of valuable materials highlight the urgent need for systemic change. Among the potential solutions, bottle bills — especially when modernised — are a proven and effective tool for addressing these systemic issues.

Modernising deposit return systems by increasing deposit values, expanding coverage to include a broader range of beverage containers and improving accessibility and convenience for consumers can unlock their full potential. These enhancements would transform the U.S. recycling landscape by not only driving higher recycling rates but also recapturing billions of dollars in material value that would otherwise be lost to landfills or incineration. Not to mention the recovered and recycled U.S.-made rPET could be sold not only to domestic end users but also to meet Europe’s growing demand for rPET — providing a significant boost to the U.S. economy.

The momentum is already building. States such as Connecticut and California have demonstrated that modernised DRS programmes can deliver measurable results in a short period. Moreover, industry stakeholders increasingly recognise the value of these systems in securing clean, high-quality recyclables to meet sustainability and recycled content mandates. Aligning U.S. programmes with global best practices can ensure the country remains competitive in a world moving decisively toward a circular economy. The path forward is clear: Modernising DRS in the U.S. is not just a choice but a necessity for a circular economy.